Trying to get a budget established can be difficult and is by no means fun. It takes time to set up and figure out how much goes to each expense. The problem some people will have is that when creating a budget, especially on a spreadsheet, is that it is not tangible. It becomes difficult to make a connection with this method. In those cases, it may be better to try something like the envelope method for saving money. This was one method that I had found while reading through articles from Dave Ramsey.

So what is the Envelope Method?

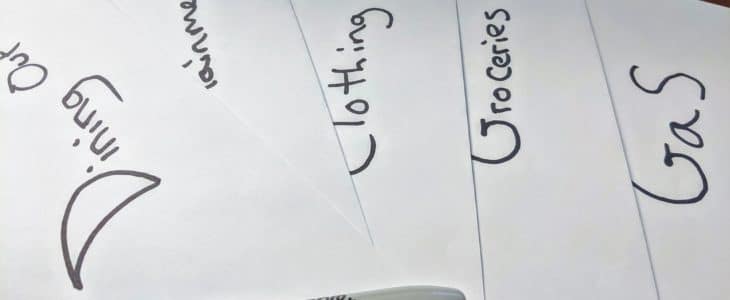

The envelope method is exactly as it sounds like, it is a system that uses envelopes to create a system of organization in order to keep track of money and expenses. As stated above, if you have trouble with money because it is not tangible, then this method may work better for you. The other name you may see is the clip method or system which is the same thing. With the only exception being that you use paper or money clips instead of envelopes.

1. How much do you need for bills

The easiest way to do this is to look over your bigger bills. These can be mortgage, car payments, cellphone. This should be subtracted from your monthly income. The reason behind this is that these types of bills are usually paid online or with checks. Subtracting these early on, it makes it easier to make sure that the money is balanced correctly. The bigger expenses should be taken care of first as they have little to no flexibility. So make a list of these bills with the total cost for the month, then subtract from monthly income. With this, I would also advise about 10% going automatically into savings, if possible. If this is not then 5% would be adequate.

2. What is left and what are your added expenses?

From there, make a list of the added costs that you run across throughout the month/year. This can be a variety of things and can be things that only come up a couple of times a year. Here are a few that may come up.

- Restaurants/going out

- Entertainment/movies/night out

- Gas

- Groceries

- Gifts/presents

- Hair cuts

- Car registration/maintenance – add to each pay period

- Home improvement

- Clothes

For the most part, most people’s envelopes will be about the same but there may be small things that come up as well. You can adapt this each month as may have forgotten an expense the month prior. The easiest way to make sure that you are set up correctly is to review your last bank statement or credit card statement to see what your money was spent on previously. There are apps such as Mint that will track monthly expenses and give you an average of what you are spending per category.

Some people will opt for an Online shopping envelope that they can move money into later. This is all dependent on how much shopping you do and where it tends to take place.

3. Setting up categories

After you have the envelopes marked up, it’s time to add the cash. For this, we return to your bank statement to find out roughly how much goes into each account. You should add a certain percentage to the envelopes with each paycheck. The amount will vary from person to person. Once you have accounted for the other expenses and you know how much you should have left over per paycheck. Then start to look at things that randomly come up.

Certain things such as haircuts, don’t change all that much so this will be easy to add to. For categories such as groceries or gas, you will need to average out how much you have spent over a few weeks/months. A lot of this will be trial and error to find the right amount for each category. It is best to put more than you need in groceries and gas compared to entertainment. Going out is nice but difficult to get there if you run out of gas.

4. Pay with only the cash

This is crucial, you have to stick to only paying with cash. This system works but only if you stick with it. It can be difficult at times because things come up and trying to figure out what to do but the base spending should come from the envelopes. If you spend all of the money in one envelope then that is all you have until the next paycheck. This is where it is difficult starting out because the estimates may be reasonably close or could be completely off.

You can re-evaluate each paycheck or each month to see what is working and what isn’t. This is why I will repeat to overestimate the bigger expenses and adjust as you go. Paying only with cash can be difficult at times but preplanning a little bit helps. It does take a lot of dedication but can make a huge difference to your budget.

5. Bank whatever is left over

At the end of each month, whatever is left over from the envelopes can be put towards your savings. Any extra money will not be accounted for and will be on top of your savings. This will be on top of what you are typically putting towards your savings each month. The amount of extra will vary from month to month of how much extra is being put away. If you want a little more flexibility in your spending each, then you can adjust the amount that is going towards savings. If you have a budget for $250 per paycheck towards groceries but find that you actually only spend $200, You can adjust the budget for the following month/week to $200 and put more towards entertainment or just into your savings.

Pros

1. Keeps you focus

The biggest Pro of the envelope method is that it will help keep you focused on your savings. It can be difficult but this gives you something in hand to provide reassurance. A lot of people will start with trying to save digitally But realize a few months down the road That their goal to build up their savings is starting to slip.

2. The savings is tangible

This falls in line with the focus component. The times when somebody is trying to save money on a spreadsheet but it doesn’t feel real. They may feel like they are limiting themselves without any visual cues. With the envelope method whatever is saved at the end of the month, you’re able to see and feel. This creates a reaffirmation of your goals and the change within your lifestyle. For this reason, people are more likely to stick with this type of savings plan. Being able to see the savings will create a psychological response that you want to stick with it for the long run.

3. Provides an emergency fund

One of the biggest benefits that were highlighted by Dave Ramsey with this program, is that it provides an emergency fund for unexpected circumstances that can arise. More often than not they will carry their credit card and debit cards but may or may not actually have cash on hand. This method makes sure that you will always have at least some money that is accessible. We’ve all been in that situation when we get to the grocery store and they come over the intercom saying that their credit card systems are down. If there are ever issues with card readers or systems being down at stores then you’re still able to continue with your purchases.

4. Less likely to needlessly spend

When you have a system in place for saving money then it can feel rewarding especially after a few months. With this being the case you are more likely to stick with the method. It can almost feel like a challenge and make you want to try to save more. This will help prevent you from spending money on things that you don’t need. You are more likely to follow other principles such as the 30-day rule in order to maximize savings and reduce needless spending.

5. Don’t have to worry about overdraft

One of the biggest benefits of this method is that it reduces the risk of overdraft fees. There is some slight risk of overdraft due to paying for other bills online. But the overall risk is very low. This is due to limiting your spending and not using plastic to pay for anything, such as debt or credit cards. Keeping yourself focused and disciplined, this method can go a long way for saving money towards paying off debt or for saving for your vacation.

Cons

1. Can be overly strict for some

With this method, the same reason that it works so well is the same reason that it can be a problem. The biggest drawback from the envelope method for savings is that it can be very restricting. There is very little leeway with any type of spending that does not fall within set categories. If you find something that you want to buy that is outside the normal spending, you have to figure out what category/categories the money will come from. In these cases, you can adjust during the next pay cycle to potentially free up some money for outside spending. I would still recommend against it as it is about maximizing savings but sometimes life gets in the way.

2. Does Not take advantage of reward programs

One of the things that we always do is to take advantage of various reward programs and with the envelope method, it is difficult to do so. For a lot of people, this is not a deal breaker. It is simply adjusting mindset during the times of using this strategy. The most important thing is to pay off debts and can worry about reward programs later on. There are ways around it with this for certain reward programs such as Dunkin Donuts. You can take money out, we will say $10, of the weekly budget from entertainment or dining out to put back into your savings account and preload $10 to the digital card in order to get reward points.

3, Will need to get household on board

For a family, the only way that this will work is if you get everyone on board with this savings strategy. For some, this can be a difficult sell especially the more people there are. It can be easier when children are small but can be more challenging once they get older. With credit or debit cards, it is easier to use and that’s when individuals fall within the trap of overspending.

4. Difficulty with passing money around

Once you have gotten your family on board, you may run into a further issue. Passing off the money can be difficult if something comes up. If someone always goes grocery shopping and they carry that envelope but then the spouse needs to pick up milk after work, you either have to pass off the envelope or take money from another category. The envelope method can make it difficult for a quick spur of the moment purchases.

5. Having to go to the bank/ATM to get cash

For a lot of people, the sole reason for using plastic for a lot of purchases is so that they don’t have to go withdraw money. It can be a hassle to go get the cash in order to put it into the envelopes. If you work this into your normal routine, this issue becomes less of a problem. Just plan ahead and set it into a routine, even if its every Friday on your way home, you go to the ATM withdraw the money for the next week and set up the envelopes over the weekend.

*Bonus Tip – Carry some cash on you for emergencies. Make a category for “Wallet” that has $20 in it. This does not need to be a lot of money but it is always good to keep some cash on you instead of a credit/debit card.