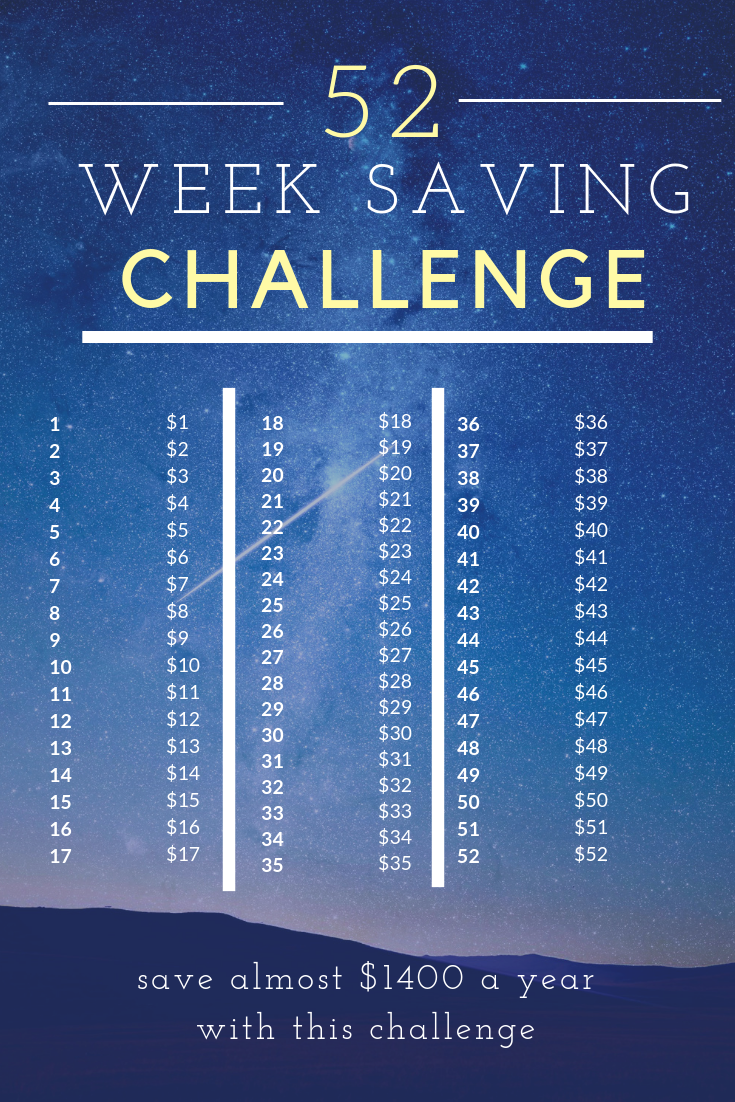

One of the most common ways to save money that you see online is through the 52 week challenge. The premise is simple, for each week of the year you add the corresponding dollar amount. So week one you add $1 to the savings fund, week 2 you add $2 to the savings fund, and so on and so forth. This may seem like a very simple concept; however towards the end of the year it may feel in little bit problematic due to having to put $52 aside. The 52 week challenge can be difficult with certain types of budgeting strategies but is doable. The biggest thing is to remember that it does take some dedication to continually set aside money into a savings fund.

Fitting to your needs

The 52-week Challenge focuses on $1 per week of the year you can always make adjustments to fit your financial abilities. If you are able to set more aside you can always do $2 per week or difficult you can always do $0.50 per week. Every little bit helps and adds up quickly over the course of the year. If you were to stick with the $1 per week challenge, at the end of the year you would have saved $1,378. If you were able to do $0.50 per week increments, you would still have saved $689 over the course of the year. More than enough for a Christmas fund or just extra money for groceries, rent, Etc.

How to do this

There are a couple of ways for you to save during the 52 week challenge. First, is using cash and setting it in a jar or someplace for safekeeping. This provides a more tangible experience which will make it more likely that you will stick with it. If you’re concerned with having that much money around your house, you can do this with your checking account and creating a secondary savings account. You can then transfer cash each week for every few weeks. Overall this is a great strategy to save money with very little thought not behind it. This is more active way of saving because of the effort to move money around.

Start with more!

If this seems difficulty, especially towards the end of the year, then maybe reverse it. What I mean by that is start with week 52 and make it a count down. This will ensure that you are still saving money and will be less difficult during the holidays. One of the biggest problems with this method is staying focused, however this method may make it a little easier due to seeing the savings build quicker. To start this: start the first week by banking $52, week 2 bank $51, etc. Doing this way, you can use this as holiday money for gifts or to buffer your savings for later in the year.

You could also move money that is saved from groceries with smart shopping into the account. This way you are less likely to notice it and will not impact your budget as much.